CIT Bank transfer fee, a silent toll levied on every transaction, a whisper of expense in the hushed halls of finance. Each transfer, a small boat launched upon a sea of charges, its journey fraught with the potential for unexpected costs. The weight of these fees, a burden felt most acutely by those navigating the complexities of domestic and international funds movement, a melancholic rhythm in the symphony of banking.

This exploration delves into the intricacies of CIT Bank’s transfer fee structure, examining the various factors that determine the final cost. We will navigate the landscape of domestic and international transfers, comparing wire transfers to ACH transfers, highlighting the often-overlooked nuances that can significantly impact the total expense. We will uncover strategies for minimizing these fees, offering a glimmer of hope amidst the financial currents.

CIT Bank Transfer Fees

Understanding CIT Bank’s transfer fee structure is crucial for managing personal or business finances effectively. This article details the various fees associated with domestic and international transfers, offering insights into cost optimization strategies.

CIT Bank Transfer Fee Types and Influencing Factors

CIT Bank charges fees for various transfer types, influenced by factors such as the transfer method, recipient bank, and the amount transferred. Wire transfers generally incur higher fees than ACH transfers. International transfers typically involve additional fees compared to domestic transfers, reflecting the increased complexity and cross-border regulations.

For instance, a domestic wire transfer of $1,000 might cost $25, while an international wire transfer of the same amount could cost $50 or more, depending on the recipient bank and country. Smaller transfers often have lower fees, but percentage-based fees can sometimes make smaller transfers proportionally more expensive.

Domestic and International Transfer Fee Comparison

| Transfer Type | Domestic Fee (USD) | International Fee (USD) | Processing Time |

|---|---|---|---|

| Wire Transfer | $25 – $35 | $50 – $75 + | 1-3 business days |

| ACH Transfer | $5 – $15 | Not typically available for international transfers | 3-5 business days |

Note: These fees are examples and may vary based on specific circumstances. Always confirm current fees with CIT Bank.

Domestic Transfers within CIT Bank: Cit Bank Transfer Fee

Transferring funds between CIT Bank accounts is a straightforward process, typically completed quickly and with minimal cost. This section details the procedure and potential processing delays.

Ugh, Cit Bank’s transfer fees? They’re highway robbery! I’m seriously considering ditching them and signing up with a bank that doesn’t bleed me dry, like maybe northone bank sign up – heard they’re much more reasonable. Then again, maybe I’ll just stick with Cit and start a savings jar – at least that doesn’t charge a fee for transferring pennies!

Intra-Bank Transfer Process and Time

Transferring funds between CIT Bank accounts can be done through online banking, mobile banking, or by visiting a branch. Online and mobile transfers usually process instantly. Branch transfers may take a few business days to reflect.

- Log in to your CIT Bank online banking account.

- Navigate to the “Transfers” or “Move Money” section.

- Select “Transfer between my accounts.”

- Choose the source and destination accounts.

- Enter the transfer amount.

- Review and confirm the transfer.

Exceptions may arise due to system maintenance or unusual account activity, resulting in slight delays.

Domestic Transfers to Other Banks

Several methods exist for transferring funds domestically to other banks, each with varying fees and processing times. This section compares wire transfers and ACH transfers, highlighting cost-effectiveness and potential trade-offs.

Wire Transfer vs. ACH Transfer

- Wire Transfer:

- Pros: Fast processing (1-3 business days).

- Cons: Higher fees.

- ACH Transfer:

- Pros: Lower fees.

- Cons: Slower processing (3-5 business days).

Choosing the most cost-effective method depends on the urgency of the transfer. While ACH transfers are cheaper, the longer processing time might be unacceptable in certain situations.

International Transfers with CIT Bank

Source: exiap.com

International transfers involve specific fees, information requirements, and potential additional charges. Understanding these aspects is crucial for accurate cost estimation.

International Wire Transfer Fees and Requirements, Cit bank transfer fee

International wire transfers typically involve higher fees than domestic transfers, reflecting the complexities of cross-border transactions. The recipient’s bank details, including SWIFT code and account number, are required. Exchange rate fluctuations can also impact the final transfer amount.

Example: A $1000 transfer might incur a $50 transfer fee, plus a 1% exchange rate fee if the transfer is in a foreign currency. This adds up to a total cost significantly higher than the initial amount.

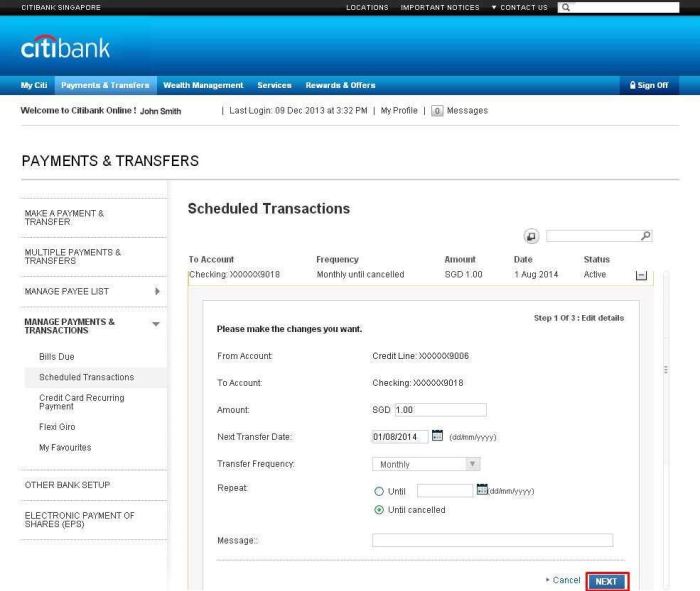

Avoiding or Minimizing Transfer Fees

Source: com.sg

Several strategies can help reduce or eliminate transfer fees. Exploring alternative methods and understanding fee structures are key.

Strategies for Reducing Transfer Fees

Using alternative transfer methods such as peer-to-peer (P2P) payment apps may offer lower fees or even fee-free transfers for certain amounts or types of transactions. However, these services might have limitations on transfer amounts or transaction types. Comparing the total cost (fees + exchange rates) across various methods for different transfer amounts is essential for optimizing costs. A visual representation would show a clear cost comparison, with a steep curve representing the cost of wire transfers versus a flatter curve for ACH transfers or P2P services.

End of Discussion

The journey through CIT Bank’s transfer fee landscape reveals a complex and often unpredictable system. While the initial cost might seem manageable, hidden fees and fluctuating exchange rates can quickly transform a simple transaction into a significant financial burden. Understanding the nuances of each transfer type, employing cost-saving strategies, and carefully weighing the speed versus cost equation are crucial steps in navigating this financial terrain.

The ultimate goal is not merely to transfer funds, but to do so with awareness and control, minimizing the melancholic sting of unexpected charges.