Cit Bank international wire transfer offers a pathway to seamlessly send money across borders, but navigating the process requires understanding its intricacies. This guide unveils the complexities of Cit Bank’s international wire transfer service, illuminating the fees, procedures, timelines, security measures, and currency exchange intricacies involved. Imagine the smooth flow of funds, the secure transmission of your money, and the peace of mind that comes with a clear understanding of the entire process.

Let’s delve into the details, painting a vivid picture of how Cit Bank facilitates global financial transactions.

From the initial steps of initiating a transfer through Cit Bank’s online platform to tracking its progress and receiving confirmation, this exploration covers every aspect. We will compare Cit Bank’s offerings to those of its competitors, providing a comprehensive analysis of fees, processing times, and security protocols. Visualizing the journey of your money from your account to its destination, we will dissect each stage, providing a clear and concise roadmap for a successful international wire transfer.

Navigating CIT Bank’s international wire transfer process can be complex, requiring precise details and adherence to specific procedures. If you encounter any issues or need clarification on fees, timelines, or required documentation, don’t hesitate to utilize the readily available CIT Bank contact info resources. This ensures a smoother, more efficient international wire transfer experience with CIT Bank.

Cit Bank International Wire Transfer Fees

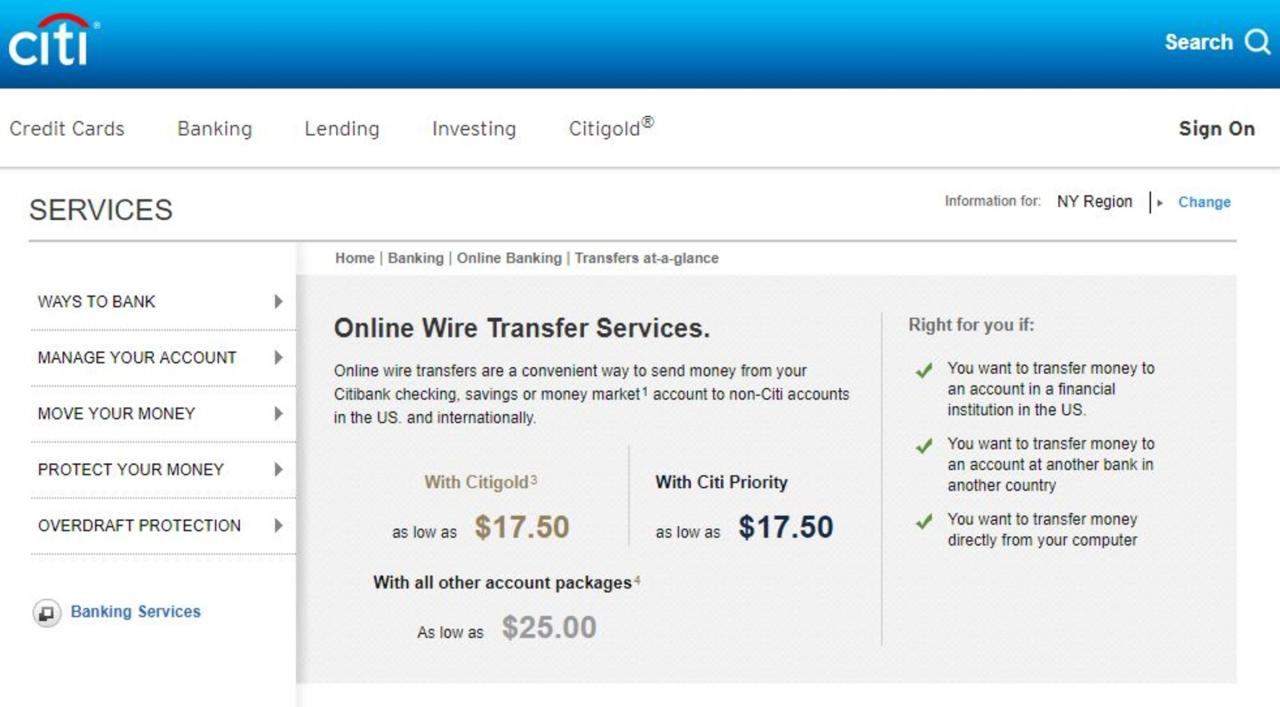

Understanding the costs associated with international wire transfers is crucial for budgeting and financial planning. This section provides a detailed breakdown of Cit Bank’s fees, comparing them to other major banks to help you make informed decisions.

Cit Bank International Wire Transfer Fee Breakdown

Cit Bank charges fees for both the sender and, in some cases, the recipient. These fees can vary depending on several factors, including the destination country and the currency involved. The following table provides a general overview; it’s recommended to contact Cit Bank directly for the most up-to-date information.

| Fee Type | Fee Amount | Currency | Applicable Conditions |

|---|---|---|---|

| Sender’s Fee | $25 – $50 (estimate) | USD | Varies depending on destination country and currency. |

| Recipient’s Fee (Potential) | Variable | Variable | May be charged by the receiving bank; not always directly by Cit Bank. |

| Intermediate Bank Fees (Potential) | Variable | Variable | Charged by correspondent banks involved in the transfer process. |

Comparison of International Wire Transfer Fees

Comparing Cit Bank’s fees with those of other major banks allows for a comprehensive cost analysis. The following table presents a comparison, but remember that fees are subject to change.

| Bank Name | Fee Type | Fee Amount (Estimate) | Currency |

|---|---|---|---|

| Cit Bank | Sender’s Fee | $25 – $50 | USD |

| Bank of America | Sender’s Fee | $45 – $50 | USD |

| Chase | Sender’s Fee | $45 – $50 | USD |

Hidden Fees and Additional Charges

While Cit Bank’s stated fees are generally transparent, it’s important to be aware of potential additional charges. These may include correspondent bank fees (fees charged by intermediary banks involved in the transfer), currency conversion fees (if the transfer involves a currency conversion), and potential penalties for incorrect information.

Cit Bank International Wire Transfer Process

Initiating an international wire transfer through Cit Bank’s online banking platform is relatively straightforward. The following steps Artikel the typical process.

Step-by-Step Guide to International Wire Transfers

The process may vary slightly depending on your specific circumstances and the platform you use. Always verify the information directly with Cit Bank before initiating a transfer.

- Log in to your Cit Bank online banking account.

- Navigate to the “Wire Transfer” or “International Transfers” section.

- Select “International Wire Transfer.”

- Enter the recipient’s bank details (name, address, SWIFT code, account number).

- Enter the transfer amount and currency.

- Review and confirm the transfer details.

- Authorize the transfer.

Required Information for International Wire Transfers

Accurate information is essential to ensure a smooth and timely transfer. Missing or incorrect information can lead to delays or even the failure of the transfer.

- Recipient’s full name

- Recipient’s bank name and address

- Recipient’s account number

- Recipient’s SWIFT/BIC code

- Transfer amount

- Currency

- Purpose of payment (optional, but recommended)

Methods for Submitting International Wire Transfer Requests

Cit Bank offers various methods for initiating international wire transfers, each with its own advantages and disadvantages.

- Online Banking: Convenient and accessible 24/7.

- Phone Banking: Allows for assistance from a customer service representative.

- Branch Visit: Provides in-person support and guidance.

Cit Bank International Wire Transfer Timeframes

The processing time for international wire transfers can vary considerably, depending on several factors. This section explores typical processing times and the factors influencing them.

Typical Processing Times

While there’s no single definitive timeframe, international wire transfers through Cit Bank generally take between 1 to 5 business days. Transfers to certain countries might take longer due to banking regulations or processing delays in the recipient’s country.

Factors Affecting Processing Time

Several factors can influence how quickly an international wire transfer is processed.

- Destination country

- Recipient bank’s processing time

- Accuracy of provided information

- Currency conversion requirements

- Bank holidays or weekends

Comparison of International Wire Transfer Speeds

Comparing Cit Bank’s processing times with those of other major banks can help you assess the efficiency of its service.

| Bank Name | Average Processing Time (Estimate) | Factors Affecting Speed | Currency |

|---|---|---|---|

| Cit Bank | 1-5 Business Days | Destination country, recipient bank processing, information accuracy | Variable |

| Bank of America | 1-5 Business Days | Similar to Cit Bank | Variable |

| Chase | 1-5 Business Days | Similar to Cit Bank | Variable |

Cit Bank International Wire Transfer Security Measures

Cit Bank employs robust security measures to protect customer data and prevent fraudulent activities during international wire transfers. This section details these measures.

Security Protocols

Cit Bank utilizes advanced encryption technology to safeguard customer information throughout the transfer process. This includes secure connections (HTTPS) for online banking and robust data protection measures to prevent unauthorized access.

Verification and Authentication Processes

Cit Bank employs multiple layers of verification and authentication to ensure only authorized users can initiate international wire transfers. This might include multi-factor authentication, password protection, and transaction limits.

Fraud Prevention Measures

Cit Bank actively works to prevent fraudulent international wire transfers through various measures, including real-time transaction monitoring, suspicious activity detection systems, and fraud prevention training for employees.

Cit Bank International Wire Transfer Currency Exchange Rates

Understanding how Cit Bank determines exchange rates and how fluctuations affect the final amount received is crucial for international transfers. This section clarifies these aspects.

Exchange Rate Determination, Cit bank international wire transfer

Cit Bank typically uses a combination of market rates and its own internal markup to determine the exchange rate for international wire transfers. The specific rate applied will depend on the currency pair and the time of the transaction.

Impact of Currency Fluctuations

Currency exchange rates are constantly fluctuating, which can affect the final amount received by the recipient. A change in the exchange rate between the time the transfer is initiated and the time it is received can result in a difference in the final amount.

Comparison of Currency Exchange Rates

Comparing Cit Bank’s exchange rates with those offered by other providers can help you find the most favorable option.

| Provider | Currency Pair | Exchange Rate (Example) | Date |

|---|---|---|---|

| Cit Bank | USD/EUR | 1.10 (Example) | October 26, 2023 |

| Wise | USD/EUR | 1.09 (Example) | October 26, 2023 |

| Western Union | USD/EUR | 1.11 (Example) | October 26, 2023 |

Cit Bank International Wire Transfer Tracking and Confirmation

Tracking the progress of an international wire transfer and obtaining confirmation of completion are essential aspects of the process. This section explains how Cit Bank handles these aspects.

Tracking Methods

Source: prismic.io

Cit Bank typically provides online tracking capabilities through its online banking platform. Customers can log in and view the status of their pending and completed transfers.

Confirmation of Completion

Source: medium.com

Confirmation of a completed international wire transfer can be obtained through various methods, including online banking, email notification, and contacting Cit Bank customer support.

Sample Email Confirmation

A sample email confirmation from Cit Bank might include the following details:

Subject: Your Cit Bank International Wire Transfer Confirmation

Dear [Customer Name],

This email confirms your international wire transfer has been successfully processed.

Transfer Details:

- Transfer Date: October 26, 2023

- Transfer Amount: $1000 USD

- Recipient Name: [Recipient Name]

- Recipient Bank: [Recipient Bank Name]

- Recipient Account Number: [Recipient Account Number]

- Transfer Reference Number: [Reference Number]

Thank you for choosing Cit Bank.

Sincerely,

The Cit Bank Team

Summary

Successfully navigating the world of international wire transfers requires careful planning and a thorough understanding of the involved processes. Cit Bank, with its robust security measures and relatively transparent fee structure, provides a viable option for many. However, understanding the nuances of fees, processing times, and exchange rates is crucial for a smooth and cost-effective experience. By carefully considering the information presented here, you can confidently execute your international wire transfers, ensuring your funds reach their destination securely and efficiently.

Remember to always double-check all details before initiating a transfer to avoid delays or complications. The global financial landscape awaits your informed decisions.